A Comprehensive Guide with Expert Breakdown for Better Financial Planning

Introduction: Know What You Owe Before You Grow

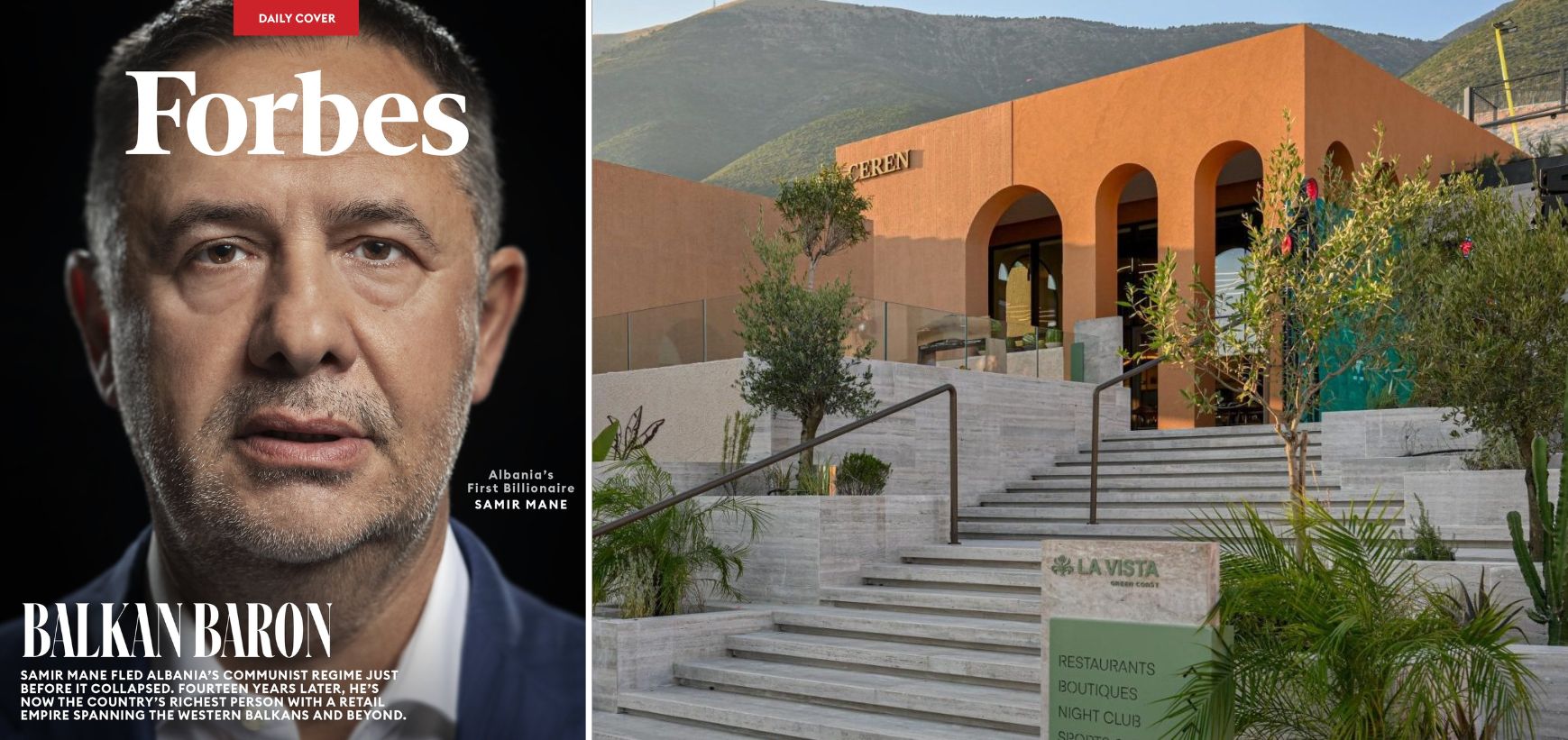

As Albania continues to grow as a business hub in the Balkans—attracting IT investments, startups, freelancers, and expats, it’s crucial to understand how income tax applies differently based on your professional activity. Whether you’re an employee, tech entrepreneur, or small business owner, this guide outlines 2025 tax slabs specific to:

- Salaried individuals

- IT professionals

- Non-IT workers

- Freelancers

- Small businesses and entrepreneurs

Let’s dive deep into Albania’s income tax system, with real-world examples, insights, and essential tips.

1. Tax System Overview: Flat vs Progressive in Albania

Albania uses progressive taxation for salaried individuals and a flat tax model for business entities. The tax structure encourages small business formation and is particularly attractive for digital nomads, freelancers, and IT startups.

2. Income Tax Slabs for Salaried Individuals (2025)

This applies to full-time employees under a labor contract.

Monthly Salary-Based Progressive Tax Brackets

| Monthly Gross Salary (ALL) | Annual Gross Salary (ALL) | Tax Rate |

| Up to 40,000 | Up to 480,000 | 0% |

| 40,001 – 200,000 | 480,001 – 2,400,000 | 13% |

| Over 200,000 | Over 2,400,000 | 23% (on the amount exceeding 200,000) |

Example:

Gross Salary = 150,000 ALL/month

- First 40,000 = 0% tax

- Remaining 110,000 taxed @13% = 14,300 ALL

- Take-home (after PIT only) ≈ 135,700 ALL (excluding social contributions)

3. Income Tax for IT Professionals & Startups

The Albanian government offers incentives for the IT sector, including reduced corporate income tax (CIT) and VAT exemptions.

Scenarios:

A. IT Employees

Same progressive tax slab as above.

B. IT Freelancers / Consultants

Registered as self-employed or under “Independent Services” regime.

- Income Tax (Flat): 15%

- Social + Health Contributions: 23%

- Taxable Base: Net profit (gross income – expenses)

Example:

Annual Revenue = 2,400,000 ALL

Allowable Expenses = 400,000 ALL

Net Income = 2,000,000 ALL

- PIT = 300,000

- Social/Health = 460,000

- Net Take-home ≈ 1,240,000 ALL

C. IT Companies / Tech Startups

- Corporate Income Tax (CIT):

- 0% for income up to 14,000,000 ALL (if registered as “small business” in IT sector)

- 15% for income above the threshold

- Dividend Tax: 8% (if profit is distributed)

4. Income Tax for Non-IT Workers & Blue-Collar Employees

Includes sectors like construction, retail, hospitality, education, healthcare, etc.

- Tax Slabs: Same as salaried individuals

- No sector-specific exemptions

- Social/Health Contributions are mandatory

Note: Many workers in these sectors are hired under short-term or part-time contracts, so their income typically falls under the 0% or 13% bracket.

5. Income Tax for Freelancers & Self-Employed Professionals (Non-IT)

Applies to consultants, creatives, artists, online sellers, etc.

| Type | Rate |

| PIT | 15% Flat |

| Social & Health Combined | 23% |

They must register as a natural person (NIPT) and declare income quarterly.

6. Tax for Small Businesses & Entrepreneurs

This category includes shop owners, small service providers, and independent operators.

Small Business Tax Regime (2025):

| Annual Turnover | Income Tax |

| Up to 14 million ALL | 0% |

| Over 14 million ALL | 15% on profit |

Conditions to qualify for 0%:

- Must be registered for at least 1 year

- Not part of high-risk industries (gambling, alcohol production, etc.)

- Maintain accounting records

Other Taxes:

- Social Contributions (for owner): ~23% of declared income

- Municipal Taxes: Varies by city

7. Dividend Tax in Albania

Applies when profits are distributed by a company to shareholders.

| Tax Type | Rate |

| Dividend Tax | 8% |

If you’re a founder/director of an IT or Non-IT company and choose to withdraw profits, you’ll pay 8% on top of your income tax.

What If You’re a Foreigner or Digital Nomad?

Albania welcomes foreign freelancers and remote workers. While there’s no official digital nomad visa yet, taxation applies if:

- You spend 183+ days/year in Albania

- You generate income locally

- Or you register a business in Albania

You’ll then fall under local PIT rules as a tax resident.

0 Comments