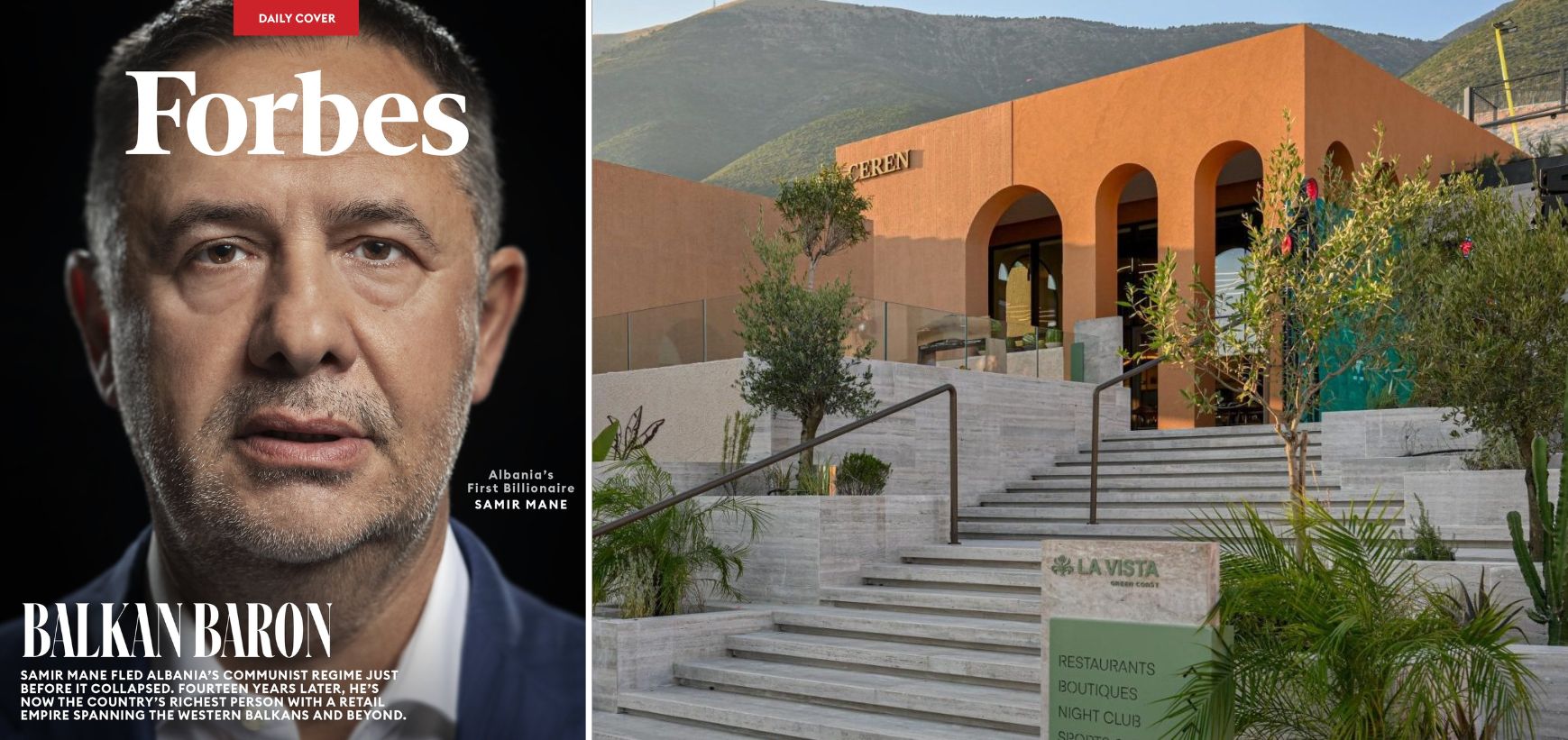

Albania is quickly becoming one of Europe’s most accessible and cost-effective destinations for launching a business. Thanks to streamlined digital processes, low operating costs, and a growing economy, setting up your company here in 2024 is not only possible, it’s easier than you might think.

Whether you’re a freelancer, a startup founder, or an investor looking to expand in the Balkans, this guide breaks down exactly what you need to know to register and run your business in Albania smoothly.

What Type of Business Should You Register?

Foreigners in Albania can register different types of legal entities depending on their business goals:

- Sole Proprietorship (Physical Person) – Best for freelancers or one-person businesses.

- Limited Liability Company (SH.P.K.) – The most popular structure for SMEs due to its flexibility and personal asset protection.

- Joint Stock Company (SHA) – Ideal for larger businesses or those planning to raise capital.

- Branch or Subsidiary of a Foreign Company – Perfect for expanding an existing international business into Albania.

Each type has different requirements, so it’s important to choose the structure that matches your short- and long-term plans.

Step-by-Step: How to Launch Your Business in Albania

Here’s a simplified version of what the process looks like in 2024:

1. Check Business Name Availability

Before doing anything else, make sure your desired company name is available using the National Business Centre name search tool.

2. Prepare Required Documentation

- Articles of Association (in Albanian), including company address, objectives, and shareholder info

- Scanned ID/passport copies of all shareholders/administrators

- An Albanian business address

- A local representative or intermediary with an active e-Albania profile (required if you don’t have one)

3. Register Online via e-Albania

The full registration is done online, free of charge, through the e-Albania portal. The process takes 2–3 working days and includes submitting your documents and electronically signing the application.

Once approved, you’ll be issued a Certificate of Registration, your company is now legally established!

What Comes After Registration?

After your business is registered, a few additional steps are required to be fully operational and compliant:

1. Register the Ultimate Beneficial Owner (UBO)

You must file UBO details within 30 days of incorporation.

2. Fiscal Registration

Register your company with the General Directorate of Taxes within 48 hours of incorporation.

3. Open a Business Bank Account

Choose from several Albanian banks to set up a corporate account in your company’s name.

4. Apply for an Electronic Fiscal Certificate

This is mandatory for issuing invoices and costs 4,000 ALL/year.

5. Obtain an Administrator’s Electronic Signature

Used for tax filings and official interactions; it costs 4,800 ALL/year.

6. (Optional) Purchase a Company Stamp

While not required, a stamp is often used for official documentation.

7. Select an E-Invoicing System

You must use an electronic invoicing program approved in Albania before you start selling or billing customers.

Need Professional Support?

Navigating bureaucracy in a foreign country can be complex, but it doesn’t have to be

Get in touch with us today to receive tailored support and ensure your business launch is fast, compliant, and stress-free.

Ready to Build Your Future in Albania?

With the right guidance, setting up a business in Albania is a straightforward process. Whether you’re relocating, expanding, or starting fresh, Albania offers a unique blend of opportunity, affordability, and accessibility.

0 Comments